Who qualifies for 'no tax on tips' and what counts as a tip? Here are the new rules

The Treasury Department is moving closer to implementing President Trump's "no tax on tips" promise

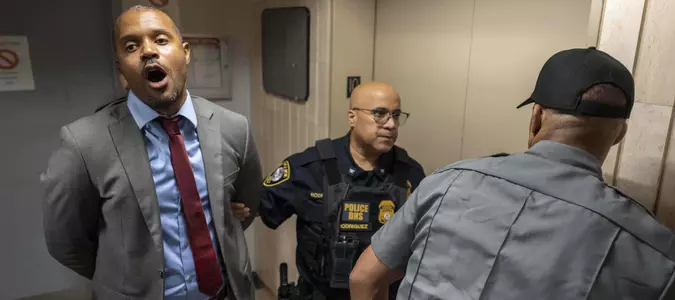

US Treasury Secretary Scott Bessent rides in a carriage during a procession through Windsor Castle on the occasion of President Donald Trump's visit, in Windsor, England, Wednesday, Sept. 17, 2025. (Toby Melville/Pool Photo via AP)

WASHINGTON (AP) — The Treasury Department is moving closer to making President Donald Trump's “ no tax on tips ” promise a reality. But new guidance released Friday tends to limit the number of tipped workers who will be able to claim the benefit.

The agency on Friday submitted proposed regulations to the Federal Register that includes greater detail on the occupations covered by the rule and who will qualify and what counts as a “qualified tip.”

The “no tax on tips” provision in Republicans’ massive tax and spending law signed by Trump in July eliminates federal income taxes on tips for people working in jobs that have traditionally received them and allows certain workers to deduct up to $25,000 in “qualified tips” per year from 2025 through 2028. The deduction phases out for taxpayers with a modified adjusted gross income over $150,000.

To qualify as a tip, the tips must be must be earned in an occupation on Treasury's list of qualified occupations. Among the jobs exempted from tax on tips are sommeliers, cocktail waiters, pastry chefs, cake bakers, bingo workers, club dancers, DJs, clowns, podcasters, influencers, online video creators, ushers, maids, gardeners, electricians, house cleaners, tow truck drivers, wedding planners, personal care aides, tutors, au pairs, massage therapists, yoga instructors, skydiving pilots, ski instructors, parking garage attendants, delivery drivers and movers.

The tip must be voluntarily given, so mandatory tips or auto-gratuities would not qualify for the “no tax on tips” benefit. However, tip pools and similar arrangements qualify, so long as they are reported to the IRS and voluntary. The benefit is not available to married individuals who file their taxes separately.

The tip must be given in cash, check, debit card, gift card or any item exchangeable for a fixed amount of cash, unlike digital assets. And any amount received for illegal activity, prostitution services, or pornographic activity does not qualify as a tip, according to the Treasury Department.

The “no tax on tips” provision will be implemented retroactively to Jan. 1, 2025.

The Yale Budget Lab estimates that there were roughly 4 million workers in tipped occupations in 2023, which amounts to roughly 2.5% of all jobs.

Congressional budget analysts project the “No Tax on Tips” provision would increase the deficit by $40 billion through 2028. The nonpartisan Joint Committee on Taxation estimated in June that the tips deduction will cost $32 billion over 10 years.

Only tips reported to the employer and noted on a worker’s W-2, their end-of-year tax summary, will qualify. Payroll taxes, which pay for Social Security and Medicare, would still be collected along with state and local taxes.